How to Get Started With Automated Forex Trading

The 24-hour global foreign exchange markets never sleep, but humans must. Automated Forex trading helps traders keep up while sticking to disciplined and consistent strategies. Trading platforms use advanced algorithms that analyze large volumes of market data to detect signals consistent with the user’s trading strategy. Simply define predetermined trading parameters, and the system automatically places orders when those conditions occur.

While automated trading offers many advantages, it also carries risks. Forex traders should research and compare platforms to find the option with the right features. Then, use compatible strategies that match their trading style. Let’s dig in.

Understanding Automated Forex Trading

Investors and retail traders can use automated platforms to trade both cryptocurrencies and conventional currency pairs. Traders begin by defining their criteria:

- Identify a currency pair or set of currency pairs to trade.

- Specify the technical indicators, price levels, or price movement trends that will initiate a trade.

- Set stop-losses and additional risk management strategies to protect profits and mitigate potential losses.

From there, the trader simply funds their account and lets the platform do the work. Automated Forex trading platforms require no hands-on interventions. So, they can continue executing trades throughout the trading day.

Automation has transformed traditional approaches to currency trading, which relied on manual analysis and required the investor’s active participation. But with automated Forex trading, algorithmic tools analyze data on behalf of the investor to identify relevant market signals instantly and accurately.

Pros and Cons of Automated Forex Trading

Automated approaches to currency trading offer many advantages, but they also carry drawbacks. Carefully consider both the pros and cons in the context of your trading strategies to determine if automated Forex trading is right for you.

Pros

- Investors can execute trades instantly, improving trading efficiency.

- Traders can take immediate advantage of events like breaking news and spread discrepancies to act on opportunities.

- Automated platforms make it much easier to define and stick with a disciplined trading strategy.

- Trading platforms remove human error and emotion from the trading equation, which can lead to better and more consistent results.

- Users can backtest and validate new strategies by drawing on huge troves of historical market data.

Cons

- When using automated Forex trading platforms, an overreliance on historical data can result in underperformance in real-world trading situations.

- Technical glitches and issues requiring troubleshooting can occur, potentially leading to downtime and missed opportunities.

- Automated Forex trading algorithms are generally reliable but struggle to adapt to unexpected events or fast-changing market conditions.

- Users must still monitor the Forex platform to safeguard against order duplication, connectivity losses, or other glitches and issues that can occur.

Selecting the Right Trading Platform

To choose the right automated Forex trading platform, carefully analyze your specific needs. For example, some systems are designed for novices. Others are more affordable, offer low fees, or provide a deeper and enriched set of data and analysis features.

Try to identify the core characteristics you want from the platform. Look for platforms that offer those characteristics and pare down your list with pricing and user reviews. Then, compare the platforms that made your shortlist. Consider the following factors:

- Features and Functions. See what each platform offers in terms of charting features, time frames, technical indicators, and drawing tools. Make sure the platform supports backtesting and has an effective alert system. Ensure the platform can execute trades quickly and efficiently.

- Compatibility. Be sure the platform is fully compatible with all your devices, browsers, and operating systems. Look for clear, intuitive user interfaces and a responsive and stable user experience.

- Accessibility. Platforms that offer both web and mobile apps ensure you can access the trading software from anywhere.

- Security. Look for advanced user security features that will protect your account and your funds. Also, make sure the platform meets all applicable regulations and compliance requirements. Read the user agreement so you understand if or how the platform will use the data it collects.

- User Education and Research Resources. The best platforms provide hands-on tutorials and other resources to help you learn new skills and strategies. It’s also best to choose a platform that connects users with expert analysis and market commentary, especially if you’re a beginner.

Most automated Forex trading platforms offer new users free demos or short-term trials. Take advantage of these offers to see if you like the way the platform operates in dynamic, real-world scenarios.

Setting Up Automated Trading Strategies

Automated Forex trading platforms support a wide range of strategies. Of course, you’ll have to design and implement your strategy yourself. Follow these four key steps to develop it:

1. Create a Plan

First, define your trading objectives in specific terms. Think beyond simple factors such as payout targets and consider:

- Currency pairs you’ll target

- The currency market(s) you’ll trade on

- Your risk tolerance and how you plan to manage risk

- Specific Forex trading strategies you want to use

2. Configure Your System

Most automated trading platforms rely on technical analysis and have significant limitations when it comes to applying fundamental analysis. So, it generally works best to choose a strategy that relies more on technical indicators.

Use trading signals to define your parameters. Then, decide whether you want the system to place a trade when conditions are met or send you an alert so you can act on the opportunity.

3. Use Risk Management Features

Experienced traders mitigate risks by setting stop limits that will ease losses when the market goes against them. Automated Forex trading platforms typically offer basic, guaranteed, and trailing stops, each of which has its own particular benefits and use cases.

4. Backtest Your Strategy

Backtesting is the process of using historical trading data to validate your strategy before you deploy it in real life on active markets. Quality Forex trading platforms offer extensive backtesting features. So, take advantage of them before you push your account live.

Best Practices for Automated Forex Trades

In addition to backtesting, you should follow markets closely. Perform thorough market research and also adapt your strategies in response to shifting market conditions. Market research can involve technical analysis, fundamental analysis, and charting. You’ll have to put in the work to build your understanding of these concepts and learn to apply them.

One significant downside of automated Forex trading is the inability of algorithmic systems to respond to unexpected events and dynamic changes in market conditions. When these events occur, it’s best to hit the pause button, reconsider your strategy, and update your trading parameters before continuing.

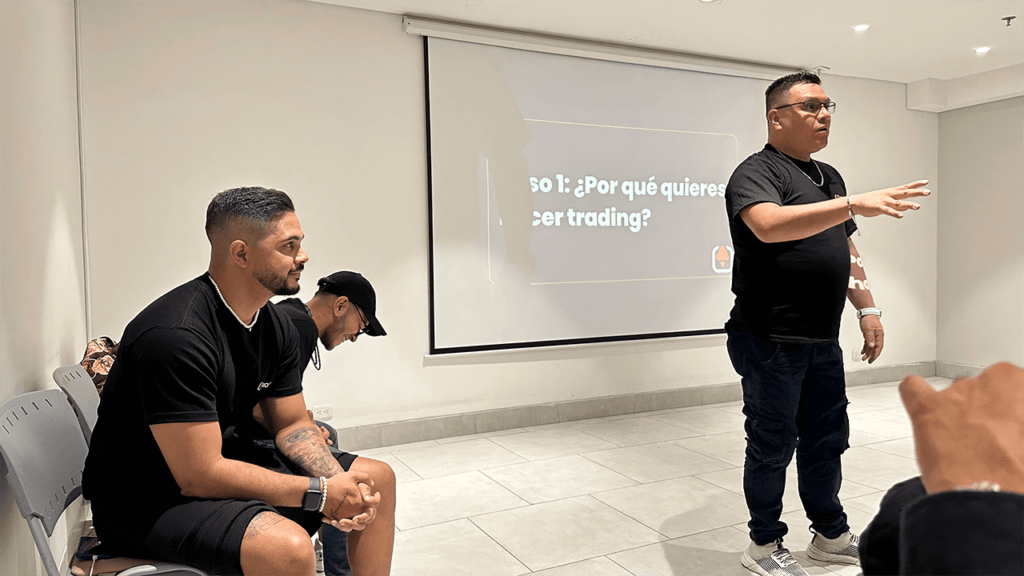

Become a Funded Trader

As you build confidence with the Forex markets, you may decide to give the world of professional trading a try. Rocket 21 Challenge can help you get there through exciting challenge programs that lead to virtual funded trading opportunities.

Enhance your Forex trading skills, compare challenges, and more. Visit Rocket 21 Challenge today to get started.